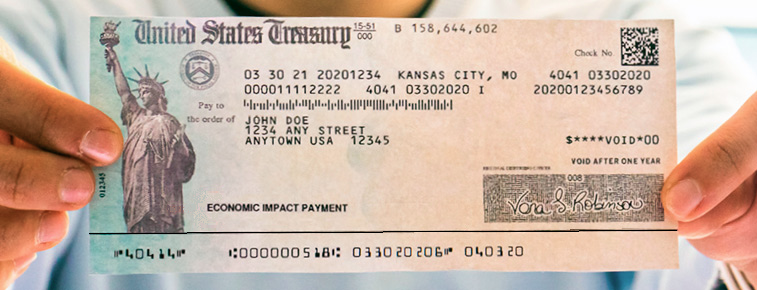

In a press release this week, the IRS confirmed that the $1,200 pandemic stimulus payments (officially called “Economic Impact Payments” under the CARES Act) received by nursing home residents remain their property. Under long-standing Medicaid law, income tax refunds follow special rules that treat these as an asset that can be spent over the following YEAR by Medicaid recipients without any penalty to their Medicaid benefits. It is not considered income paid as “applied income” to a nursing home and it does not count against the $1,600 resource limit so long as it was spent – but not given away, normally – over the year following receipt.

Continue reading