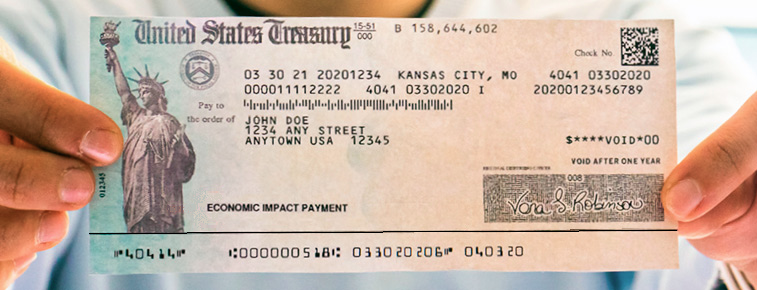

In a press release this week, the IRS confirmed that the $1,200 pandemic stimulus payments (officially called “Economic Impact Payments” under the CARES Act) received by nursing home residents remain their property. Under long-standing Medicaid law, income tax refunds follow special rules that treat these as an asset that can be spent over the following YEAR by Medicaid recipients without any penalty to their Medicaid benefits. It is not considered income paid as “applied income” to a nursing home and it does not count against the $1,600 resource limit so long as it was spent – but not given away, normally – over the year following receipt.

Since the CARES act was passed, and technically issued these payments as income tax refunds, practictioners like myself have argued that they were retained by nursing home residents, even where they were on Medicaid and the facility was managing their Social Security money as “Representative Payee.” However, certain facilities disputed this and were applying these payments – received only because the government relied on direct deposit information for Social Security for non-tax-filers – to outstanding or current nursing home bills.

If social security or other funds are being managed for your loved one by a nursing home, you may wish to request a copy of their resident trust account statement to confirm that the funds have been retained there, or to demand a refund if not. If you have any problems with this, or other care/visitation compliance in these changing times, please call our office at 203-871-3830 for a free consultation.

TEXT OF PRESS RELEASE:

WASHINGTON – The Internal Revenue Service today alerted nursing home and other care facilities that Economic Impact Payments (EIPs) generally belong to the recipients, not the organizations providing the care.

The IRS issued this reminder following concerns that people and businesses may be taking advantage of vulnerable populations who received the Economic Impact Payments. The payments are intended for the recipients, even if a nursing home or other facility or provider receives the person’s payment, either directly or indirectly by direct deposit or check. These payments do not count as a resource for purposes of determining eligibility for Medicaid and other federal programs for a period of 12 months from receipt. They also do not count as income in determining eligibility for these programs.

The Social Security Administration (SSA) has issued FAQs on this issue, including how representative payees should handle administering the payments for the recipient. SSA has noted that under the Social Security Act, a representative payee is only responsible for managing Social Security or Supplemental Security Income (SSI) benefits. An EIP is not such a benefit; the EIP belongs to the Social Security or SSI beneficiary. A representative payee should discuss the EIP with the beneficiary. If the beneficiary wants to use the EIP independently, the representative payee should provide the EIP to the beneficiary.The IRS also noted the Economic Impact Payments do not count as resources that have to be turned over by benefit recipients, such as residents of nursing homes whose care is provided for by Medicaid. The Economic Impact Payment is considered an advance refund for 2020 taxes, so it is considered a tax refund for benefits purposes. . . .

https://www.irs.gov/newsroom/irs-alert-economic-impact-payments-belong-to-recipient-not-nursing-homes-or-care-facilities